Utility Solar and Energy Storage Market Update

Victor Phan, 21 November 2022

Q2 2022 UTILITY-SCALE SOLAR MARKET UPDATE1

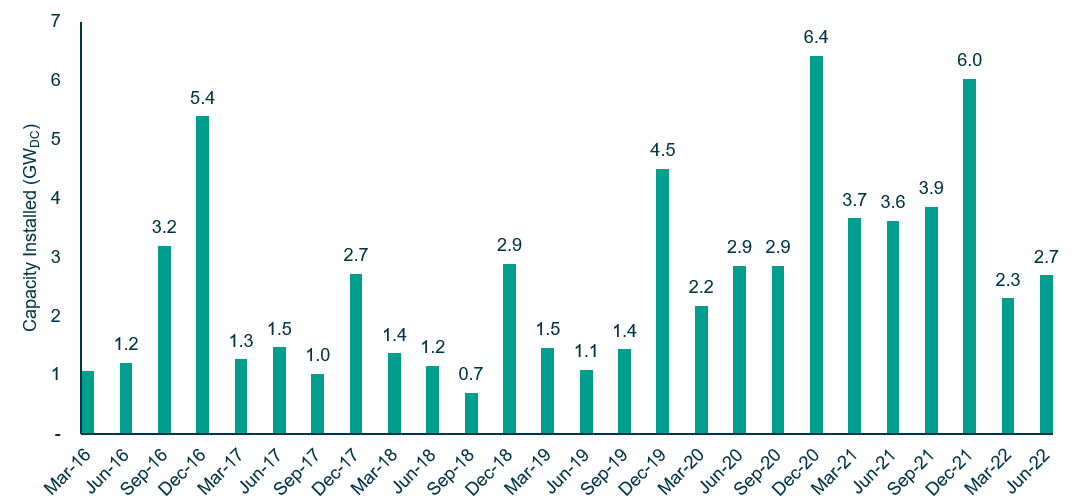

The US utility-scale solar industry installed 2.7GWDC of capacity in the second quarter of 2022, a 17% increase from Q1 2022 and a 25% decrease from Q2 2021. Installation levels for the first half of the year were at their lowest level since 2019. The lower installation total was driven largely by supply chain constraints and the initiation of the anticircumvention investigation which triggered the industry-wide slowdown from March through June. Despite these slowdowns, Q2 installations for 2022 were still 83% higher compared to installations five years prior. Additionally, over 10GWDC of new contracts were signed over the quarter, bringing the total utility-scale solar pipeline to 88GWDC.

Figure 1: US utility-scale PV capacity installed by quarter

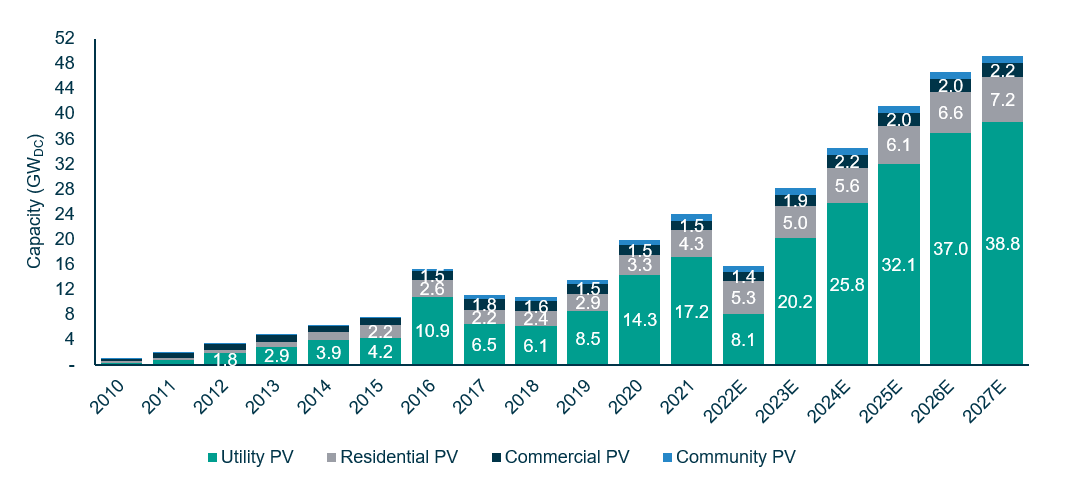

Although 2022 showed a decline after consistent record setting years, 2023 is expected to return to strong growth and the market continues its momentum with 162 GWDC to be added between 2022 and 2027.

Figure 2: US utility-scale PV capacity installed and forecasted by year

This momentum is partially driven by increasing federal level support in the US. In August 2022, the Inflation Reduction Act (IRA) was signed into law. This act provides the US solar industry with the most long-term certainty for federal tax credits it has ever had. There will now be 10 years of certainty between the extensions of the current Investment Tax Credit (ITC). Within the last decade there has only been one, two or five year extensions of the ITC.

In addition to the extension of the existing ITC, there will be a new technology-neutral tax credit that begins after 2024. The US solar industry will also benefit from an investment and production tax credit for domestic solar manufacturing. These additions are expected to bolster the US solar supply chain and industry over the long term.

There are numerous other provisions of the IRA that will indirectly benefit the solar industry, including but not limited to an ITC for standalone storage projects, expanded tax credits for electric vehicles as well as multiple zero or low carbon technologies, including hydrogen, carbon capture and sequestration, direct air capture, etc.

Over the next five years, Wood Mackenzie projects that the passage of the IRA will boost total solar deployment by 62 GWDC, or 40%, compared to Wood Mackenzie’s previous outlooks without the passage of the IRA. The US utility scale solar segment benefits the most from the IRA, increasing 47% or 52GWDC over outlooks without the IRA, supporting continued momentum for the market.