2023 Third Quarter Update

Victor Phan 30 November 2023

US UTILITY-SCALE SOLAR MARKET UPDATE1

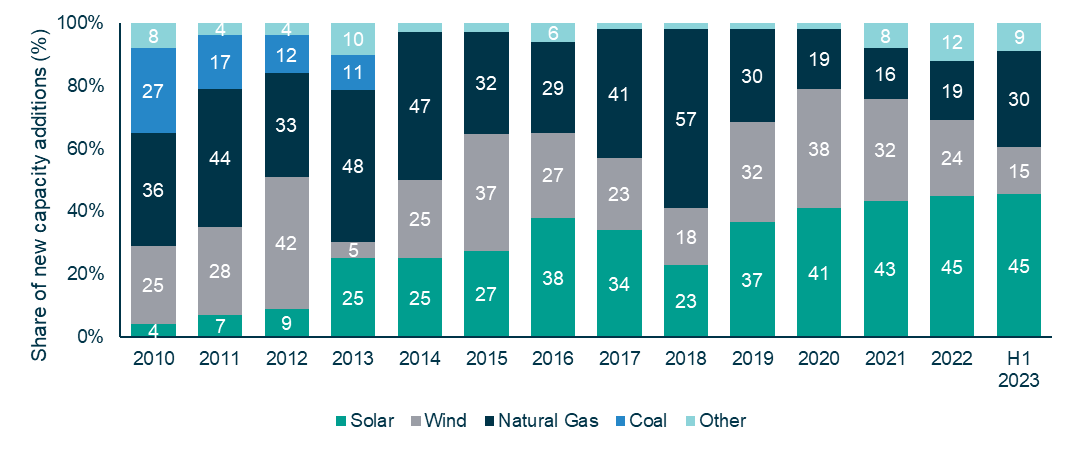

In the second quarter of 2023, the US photovoltaic (PV) solar industry added 5.6 gigawatts of direct current (GWDC) capacity to market. This represents a 20% increase when compared to the same period in 2022. In H1 2023, almost 12 GWDC of capacity has been brought online, a significant increase from the 8GWDC in the first half of 2022. In the first half of 2023, solar contributed to 45% of the total new electricity generation capacity added.

Figure 1: New US electricity-generating capacity additions, 2010 – H1 2023

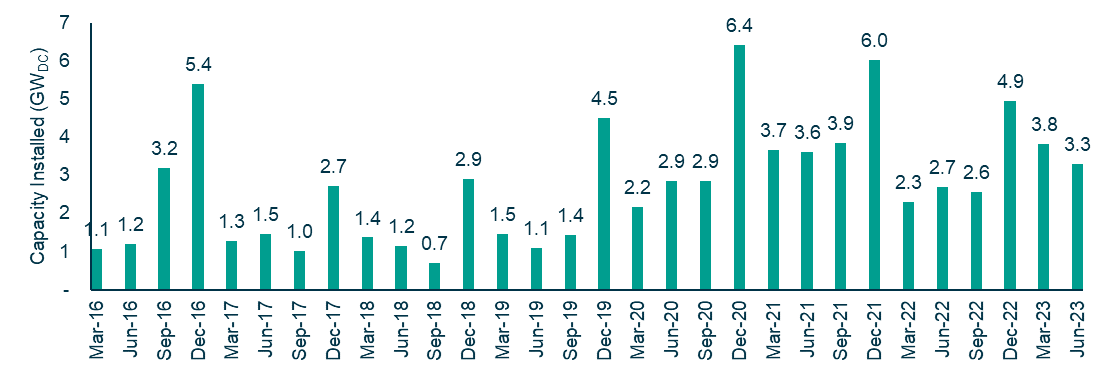

The US utility-scale solar industry has gradually rebounded from the supply chain challenges it faced in 2022. The segment recorded an impressive 22% year-over-year growth and installed 3.3 GWDC in the second quarter of 2023. Additionally, more than 3.2 GWDC of new contracts were signed during the quarter, maintaining the project pipeline at a robust 89.4 GWDC.

Figure 2: US utility-scale PV capacity installed by quarter

The solar module supply chain has slowly stabilized with US Customs and Border Protection (CBP) continuing to release modules containing non-Chinese polysilicon. The recent final determination regarding the anticircumvention case by the Department of Commerce didn’t bring any significant surprises to the industry. President Biden's two-year waiver extends the industry's ability to import modules from Southeast Asia without tariffs until June 2024. This extension enables buyers to import equipment that needs to be installed or used by early December 2024 to avoid the application of new tariffs.

In June 2023, the IRS released further details relating to direct pay and transferable tax credits available under the Inflation Reduction Act of 2022 (IRA) and the The CHIPS and Science Act of 2022 (CHIPS Act). The IRS guidance concerning tax credit transferability and the low and middle-income adders closely aligned with industry expectations and didn’t significantly affect Wood Mackenzie’s outlook for the utility-scale solar sector. The domestic content tax credit adder remains to be the most uncertain IRA benefit, as the current guidelines practically require solar modules to include US-made cells. As a result, many projects and developers may find it challenging to manage the administrative burden and risk associated with using this adder. While the final guidance is still pending, industry stakeholders are hopeful for modifications to these requirements.

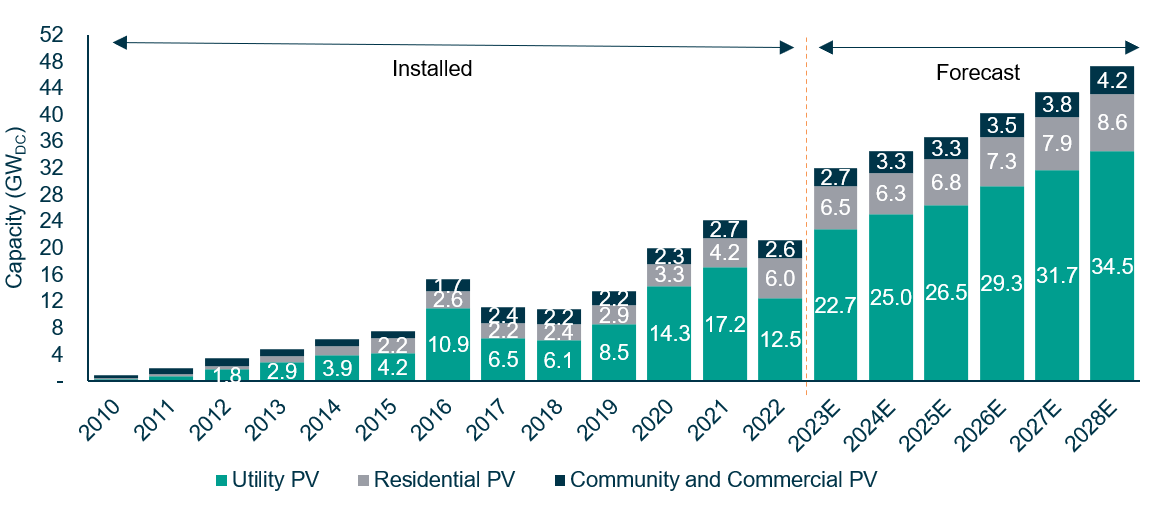

Wood Mackenzie's forecast predicts a total of 170 GWDC in utility-scale solar installations between 2023 and 2028. The first half of 2023 witnessed large installation levels, and an increased number of projects under construction, resulting in a 2.5 GWDC and 1.6 GWDC boost to Wood Mackenzie’s 2023 and 2024 projections, respectively. However, due to labor availability constraints, Wood Mackenzie has reduced the 2025-2028 buildout by 6.5 GWDC (4%).

Figure 3: US utility-scale PV capacity installed and forecast by year

1 Wood Mackenzie / SEIA U.S. Solar Market Insight®. The Q1 2023 report (2022 Year in review) provides data through Q4 2022.