US Extends Solar Tax Equity Program and Implements Energy Innovation Funding Package

Liam Thomas, 12 January 2020The recently approved US legislation to extend US$900 billion of coronavirus relief and decree US$1.4 trillion in federal spending and tax extensions also contained consequential clean energy support measures. The energy innovation package has bipartisan support having been spearheaded by Senate Energy Chair, Republican Lisa Murkowski from Alaska, and Democratic Senator Joe Manchin from West Virginia1.

The legislation increases the Income Tax Credit (ITC) for solar power through 2023, extends the Production Tax Credit (PTC) for wind for one year, extends offshore wind credits through 2025, provides US$35 billion for energy technology research and development2, and establishes a target for construction of renewable energy on public lands.

Tax Incentives

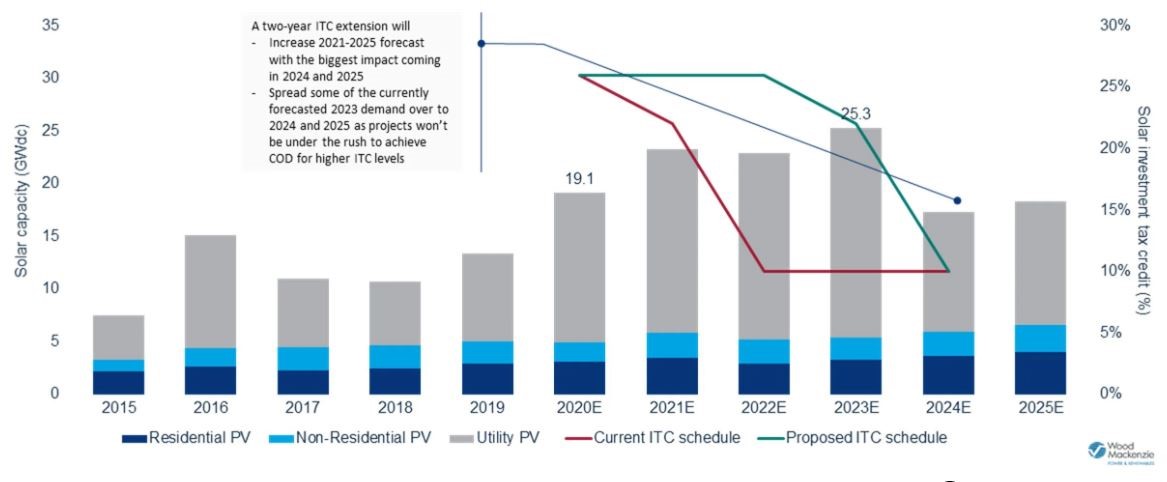

Prior to the legislation, the solar ITC was scheduled to decline at the end of 2020 to 22% and then again to 10% at the end of 2021. The increase means that the ITC will remain at 26% for projects that begin construction by the end of 2022, will fall to 22% for projects that begin construction by the end of 2023 and then fall to 10% for large scale solar projects and to zero percent for small scale solar projects commencing construction from 2024 onwards.

Source: Wood Mackenzie as reproduced in “Congress Passes Spending Bill With Solar, Wind Tax Credit Extensions and Energy R&D Package” Jeff St John Greentech Media December 22, 2020

"The two-year increase will enable more projects to secure the 26% and 22% credits through the commencement of “physical work of a significant nature” or “safe-harbouring” by the end of 2023."

The two-year increase will enable more projects to secure the 26% and 22% credits through the commencement of “physical work of a significant nature” or “safe-harbouring” by the end of 2023.

According to the Solar Energy Industry Association (SEIA), the ITC is one of the most important federal policy mechanisms in the clean energy transition and estimates that the average annual solar growth rate in the US since the enactment of the ITC in 2006 is 52%. SEIA believes that the longstanding nature of the policy has enabled business to continue to drive down costs and to invest with confidence in renewable energy3. US Solar Fund has benefited from the ITC program by partnering with tax equity investors who can efficiently monetise the tax benefits of the ITC and accelerated depreciation.

Tax equity investors include banks, insurance companies, and large corporates. Demand for tax equity funding tends to exceed supply4, so an established presence as a cash equity investor and strong relationships with tax equity investors are very important. New Energy Solar Manager has strong relationships with USBank and Wells Fargo and has closed multiple tax equity financings with both investors. Despite the coronavirus and the slowed economy in 2020, tax equity investors have reported that they expect to see solid growth in investment in solar and wind projects going forward5.

R&D Funding

The R&D funding package included in the legislation comprises approximately US$35 billion for Department of Energy programs over the next five years. Areas of research and development that will benefit from the funding include:

- Programs to improve solar PV energy efficiency and cost-effectiveness, solar panel manufacturing and recycling and the integration of solar power into the grid;

- Wind, geothermal, hydro and marine power technology research;

- Research into energy storage commercialization including multi-hour-duration distributed batteries and control systems to manage their interaction with the grid, plus long-duration storage technologies such as pumped hydro and compressed-air energy storage;

- Grid modernization technology to improve the integration of renewables, batteries and electric vehicles and develop technology standards and control platforms to manage these applications;

- Cybersecurity investment to protect the Department of Energy and the Federal Energy Regulatory Commission, as well as US utilities and energy companies;

- Carbon capture, utilization and storage for power plants and technology to capture carbon directly from the air;

- Carbon emissions reduction technology for hard-to-decarbonize industrial sectors like steel and cement manufacturing and for shipping and aviation; and

- Nuclear power plant modernisation, improved reactor design and nuclear fusion.

Renewable Energy on Public Lands

The legislation also directs the Interior Department to set a target of at least 25 gigawatts of solar, wind and geothermal production on public lands by 2025. The Biden administration has stated that it intends to streamline permitting and to lower the costs of developing renewable energy on public lands.

Reception

Reception to the energy package has been very positive and, while most agree it alone does not constitute sufficient investment to achieve net-zero by 2050, Minority US Senate Leader (at that time), Chuck Schumer, said “Are these provisions enough to meet the demands of the science? No. But are they a significant step in the right direction? Yes.6”

Although solar is competitive in many parts of the US without tax incentives, New Energy Solar Manager expects that the solar tax credit increase may result in increased acquisition opportunities later in 2021 through 2023, and that the other components of the package will have a positive impact on the already buoyant renewable energy market in the US.

1. “Congress passes massive energy package” Kelsey Tamborrino Politico 22 December 2020

2. “Congress Passes Spending Bill With Solar, Wind Tax Credit Extensions and Energy R&D Package” Jeff St John Greentech Media December 22, 2020

3. SEIA Solar Investment Tax Credit (ITC) Fact Sheet

4. “Competition for Solar Tax Equity Is Reaching a Fever Pitch” Michelle Davis Greentech Media October 15, 2020

5. Financing markets for renewable energy rebound, tax equity could top 2019” Fotios Tsarouhis S&P Global Market Intelligence 11 September 2020

6. “Congress passes massive energy package” Kelsey Tamborrino Politico 22 December 2020