US vs UK Wholesale Electricity Market Outlook

Liam Thomas, 17 September 2021

US v UK Wholesale Electricity Markets

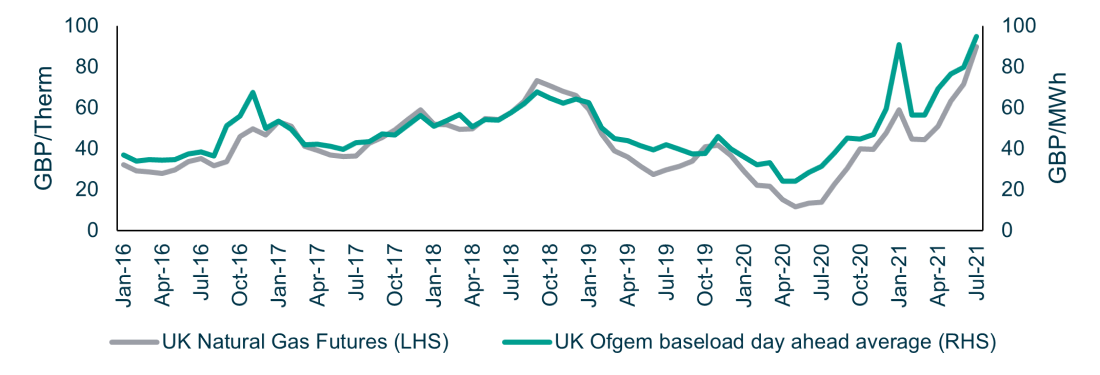

2021 has been a volatile year for US and UK electricity, driven largely by shifts in demand as economies recover from the COVID-19 pandemic and concerns over natural gas supply. UK power prices have almost doubled since the beginning of 2021 to reach their highest levels since the wholesale electricity market was established in 19901, and US power prices have increased 70%, since this time last year. The UK relies heavily on imported natural gas, making its electricity price environment particularly sensitive to supply chain challenges and variances in global gas demand. The US has abundant domestic natural gas, which has historically kept gas and electricity prices lower and less volatile. Nevertheless, 2021 has been an outlier in terms of market volatility for both regions, but particularly in the UK market.

Figure 1: US and UK Wholesale Electricity Pricing 2016-20212

UK Power Prices – Current Trends and Long-Term Outlook

Over the course of the last six months, global gas prices have risen as many economies recovered strongly from the COVID-19 crisis, prompting a surge in demand for energy. In Europe and the UK, this increased gas demand was coupled with supply challenges. A cold winter and spring in Europe put pressure on gas reserves and supply from many key global producers has been constrained. This sustained market dynamic has resulted in large gas price increases throughout Europe but has disproportionately impacted electricity pricing in the UK due to its relatively greater dependence on natural gas. In recent weeks, electricity prices have climbed further as lower than expected wind speeds have resulted in reduced wind generation and a large fire at Britain’s main electricity subsea cable has caused concerns around electricity import delays from France. The average market wholesale electricity price in the UK reached £107/MWh3 in August, a 102% increase relative to £53/MWh4 in the beginning of 2021.

Similarly, short to medium term power price forecasts in the UK have experienced upward revisions due to the strengthening of the commodity markets combined with increasing carbon prices. In the long-term, forecasters expect increasing solar and wind penetration to put downward pressure on UK wholesale electricity past 20305. However, until utility-scale battery storage is more prevalent, solar and wind will continue to require gas resource during off-peak periods, which could sustain higher electricity pricing in the UK.

Figure 2: UK Wholesale Electricity Pricing vs UK Natural Gas Futures 2016-20216

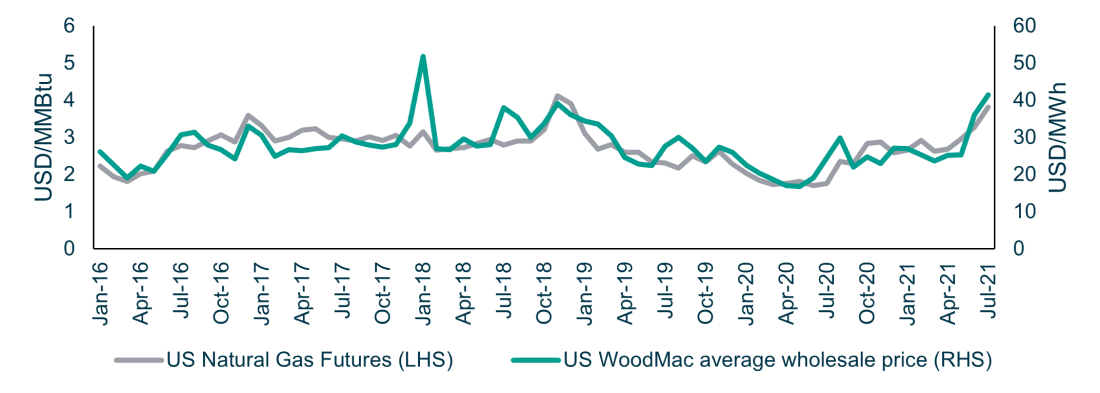

US Power Prices – Current Trends and Long-Term Outlook

In the US, gas prices have similarly increased on the back of flat production, some of the hottest summer months on record, a large storage deficit, and record exports under President Biden7. While U.S. gas and electricity pricing have historically been less correlated relative to Europe and the UK, the recent increase in gas pricing has influenced US wholesale electricity prices. The average wholesale price in the US has increased 52% from $27/MWh in January 2021 to $41/MWh in July 20218, and is up 70% compared to July 2020.

In recent years, expectations of increased penetration of low-cost renewables and a sustained low price gas environment have suppressed long-term U.S. electricity prices forecasts. However, recent forecasts have looked increasingly bullish compared to prior forecasts reflecting a shift in carbon price assumptions related to the Biden Administration’s long-term net zero targets, associated regulatory changes, and heightened global focus on emissions. A leading provider of long-term U.S. power price forecasts has revised their outlook to replace their legacy federal carbon tax with a series of extended tax credits and trading schemes. Most notable is their inclusion of an assumed zero-emission credit (applicable to both renewables and nuclear) that in many geographies, in combination with projected energy prices, is expected to increase the overall value of renewables.9

“Recent US electricity price forecasts have looked increasingly bullish compared to prior forecasts reflecting a shift in carbon price assumptions related to the Biden Administration’s long-term net zero targets, associated regulatory changes, and heightened global focus on emissions.”

Figure 3: US Wholesale Electricity Pricing vs US Natural Gas Futures 2016-202110

Impact on Solar Funds

The UK and US solar markets differ relative to the typical contractual structure of their respective offtake agreements. Typically, UK solar assets are less contracted in the near term, with exposure to near-term power pricing for a portion of their production. Conversely, US solar assets are typically 100% contracted for a range of 10-30 years under Power Purchase Agreements. As of 30 June 2021, US Solar Fund’s portfolio revenues are 100% contracted at fixed or escalating prices for a weighted average of 14.9 years as of 30 June 2021. Due to this structural difference, UK solar assets, and hence UK solar fund peers, typically have increased sensitivity to power price fluctuations. As of 30 June 2021, US Solar Fund estimates a 5.5% change in NAV from a 10% change in long-term electricity pricing compared to a range of 6.5% to 8.5% change in NAV for our publicly reporting peer group.

Recent outlooks indicate the potential for stronger prices to come over time given anticipated headwinds from the energy transition and associated structural changes in the US regulatory environment. After the PPA period, US Solar Fund is impacted by changes in power prices. Should these higher prices come into play, US Solar Fund would be well-positioned to benefit.

1 https://www.theguardian.com/business/2021/sep/02/uk-energy-bills-to-rise-after-record-wholesale-electricity-prices

2 Wood Mackenzie average of US wholesale prices for US electricity prices. Ofgem wholesale baseload day ahead converted at average spot FX for UK electricity prices

3 https://www.theguardian.com/business/2021/sep/02/uk-energy-bills-to-rise-after-record-wholesale-electricity-prices

4 https://www.ofgem.gov.uk/energy-data-and-research/data-portal/wholesale-market-indicators

5 Bloomberg New Energy Finance

6 Ofgem wholesale baseload day ahead converted at average spot FX for UK electricity prices and Bloomberg FN1 Commodity for UK Natural Gas future prices

7 https://www.forbes.com/sites/judeclemente/2021/08/02/us-natural-gas-prices-flying-through-summer-2021/?sh=5c2a3a5a2954

8 Wood Mackenzie average of US wholesale prices

9 Wood Mackenzie: North America power markets 2021 outlook to 2050

10 Wood Mackenzie average of US wholesale prices for US electricity prices and Bloomberg NG1 Commodity for US Natural Gas future prices