Investing in Solar Infrastructure in a Low Yield Environment

Liam Thomas, 20 April 2020Following the global financial crisis (GFC), low interest rates have persisted in Europe and the United States (US) for over a decade. Despite most economies recovering well after the GFC, interest rates have remained low. Recently, with the volatile markets and concerns of a recession based on the impact of Coronavirus and oil prices, treasury yields have pushed even lower off of already low interest rates.

As seen below (Figure 1), the 10-year Treasury Yield has not only been below historical norms since the GFC in 2008 but in early March it declined to 0.32%, significantly lower than the previous all-time low of 1.37% reached in July 2016.

Figure 1: 10-Year US Treasury Constant Maturity Rate

When interest rates are low, investors may struggle to find yield investments that offer reasonable returns without taking on increased risk.

Infrastructure

Lower returns from traditional ‘defensive’, or safer, asset classes like cash and bonds mean more investors are turning to alternative assets to find stable, long-term returns. One of the compelling alternatives in the environment is infrastructure. Infrastructure assets can provide a relatively steady income stream due to the long-term cash flows generated by providing essential services like electricity, water, roads, and transport like railways and airports. As such, they are less sensitive to economic cycles and can outperform traditional equities in a downturn.

Infrastructure investments also benefit from low interest rates because most infrastructure projects use some amount of debt alongside equity to finance the building or operation of the assets. A lower cost of debt (i.e. a lower interest rate) reduces the overall cost of the project, improving returns. For established projects, infrastructure asset owners can refinance debt and lock in long-term financing at historically attractive rates.

Amongst its other features, these characteristics have led global infrastructure to outperform government bonds and the overall UK equity market in recent years as seen in the graph below (Figure 1).

Figure 2: Annualized Total Return Comparison

Utility-scale solar

Utility-scale solar is a good example of infrastructure’s attractive features in terms of weighing risk and return in a low-yield or volatile economic environment. Large scale solar projects are long-life assets therefore can generate long-term cashflows by providing an essential service, electricity. As the prices of solar photovoltaic (PV) panels and components continue to fall solar becomes more competitive on a cost basis, which provides more opportunities to invest in solar assets. Solar also benefits from an increased global focus on reducing carbon emissions and investing according to Environmental, Social and Governance (ESG) criteria. A key element of ESG-focused investing is managing risk, particularly climate-related risk. For example, investing in renewables may mitigate the portfolio risks associated with potential future punitive regulation of fossil-fuel companies around carbon emissions. In this sense, investing in solar energy taps into future energy demand and is also potentially less risky than investing in other infrastructure or fossil fuel-based energy assets.

US Utility-Scale Solar

In the US, many utility-scale solar plants have long term power purchase agreements (PPAs) with investment-grade power purchasers (or Offtakers). Under these PPAs, which are typically 10-25 years in duration, the Offtaker agrees to purchase an agreed amount of electricity generated, often on a take-or-pay basis. This differs from, say, a toll road where revenues depend on traffic or a port that depends on the number of ships utilizing the port and the volume of containers transiting. Depending on the tenor and terms of the PPA, contracted solar assets can offer a lower risk than equities which offer a similar yield, or a higher return compared with fixed income products that represent a similar risk profile.

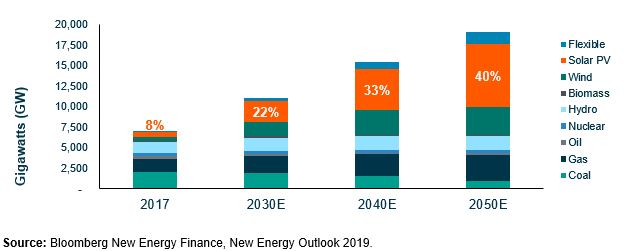

We believe that solar is well positioned in these times of economic volatility as well as relative to broader trends in the energy industry. In the chart below (Figure 2), energy industry expert Bloomberg New Energy Finance forecasts that renewables (specifically solar and wind) are expected to increase market share at significant rates in the years to come, until solar becomes the largest single source of electricity generation capacity.

Figure 3: Projected Global Installed Generation Capacity

Conclusion

With persistent low interest rates in the US and Europe and recent market volatility, investors are increasingly looking for investments that will generate an attractive return which is less correlated with the stock market or other asset classes. Many investors have seen infrastructure as an attractive investment due to comparatively higher yields and stable, long-term cashflows.

Within infrastructure, solar offers additional benefits. Not only can it provide an attractive cash yield, but in the US, cashflows from utility-scale solar are typically 100% contracted for 10 to 25 years reducing the correlation with other investments and resulting in lower exposure to market volatility, improving portfolio diversification and reducing risk.